r&d tax credit calculation uk

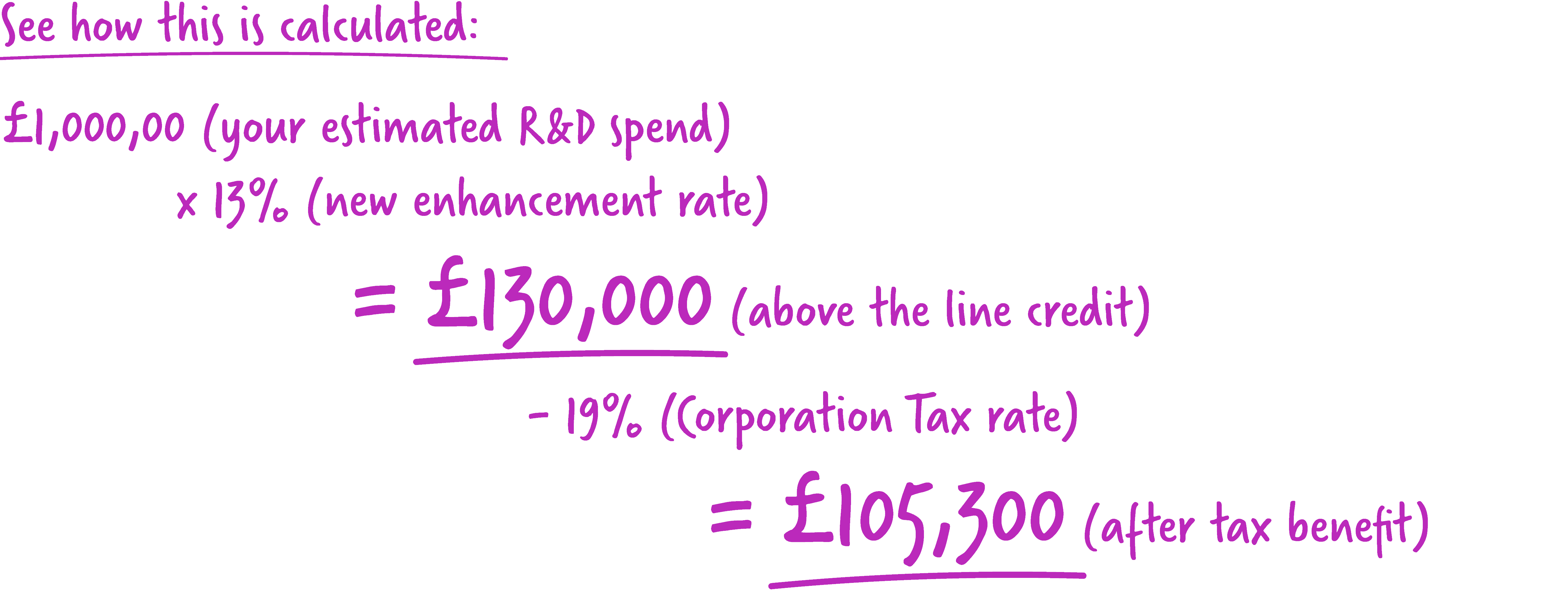

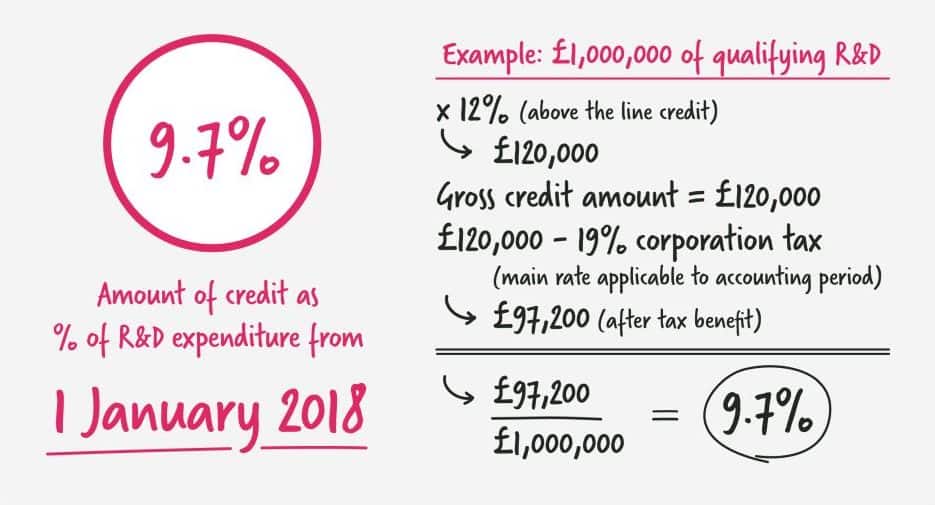

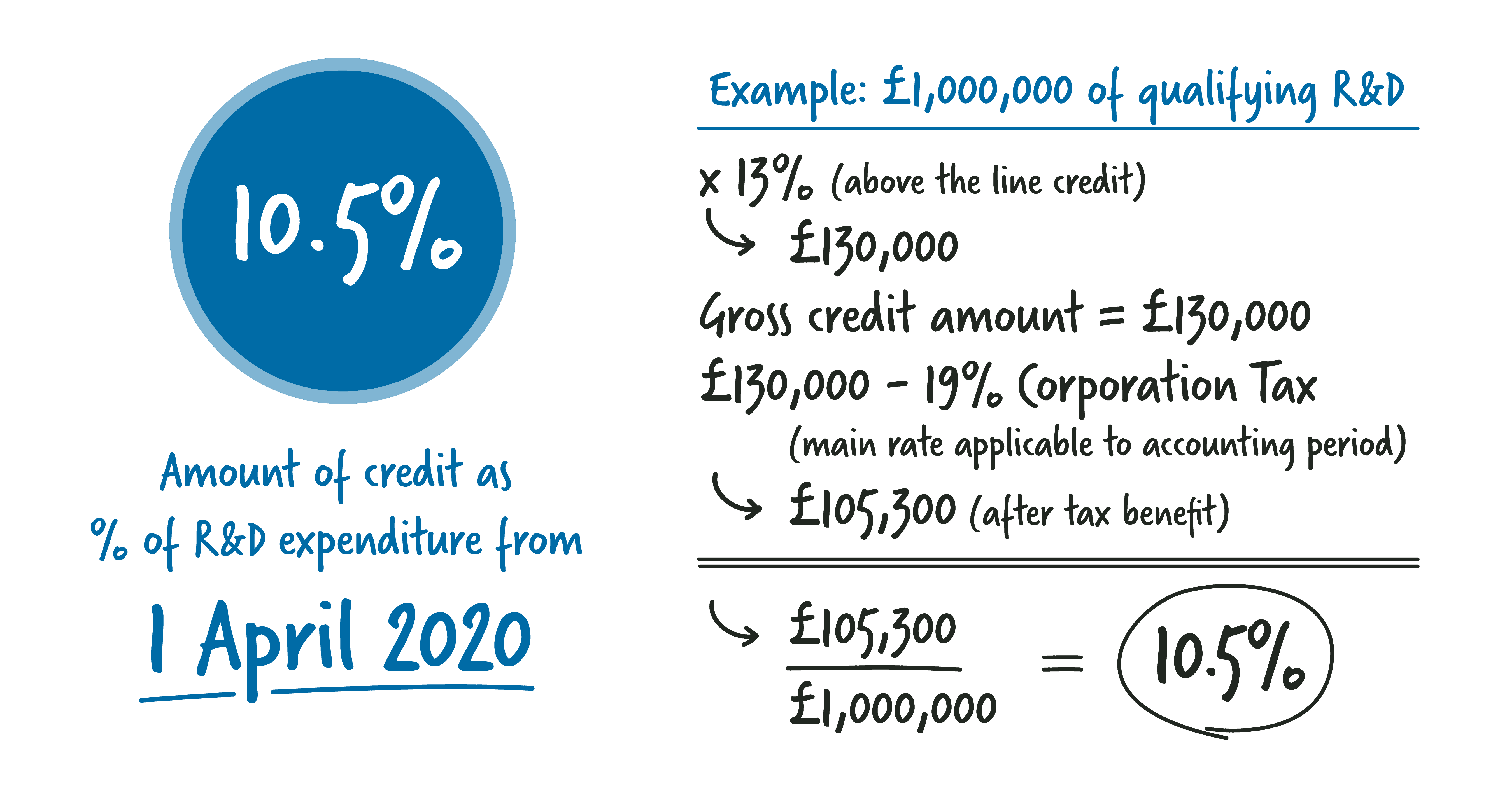

The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. It was increased to.

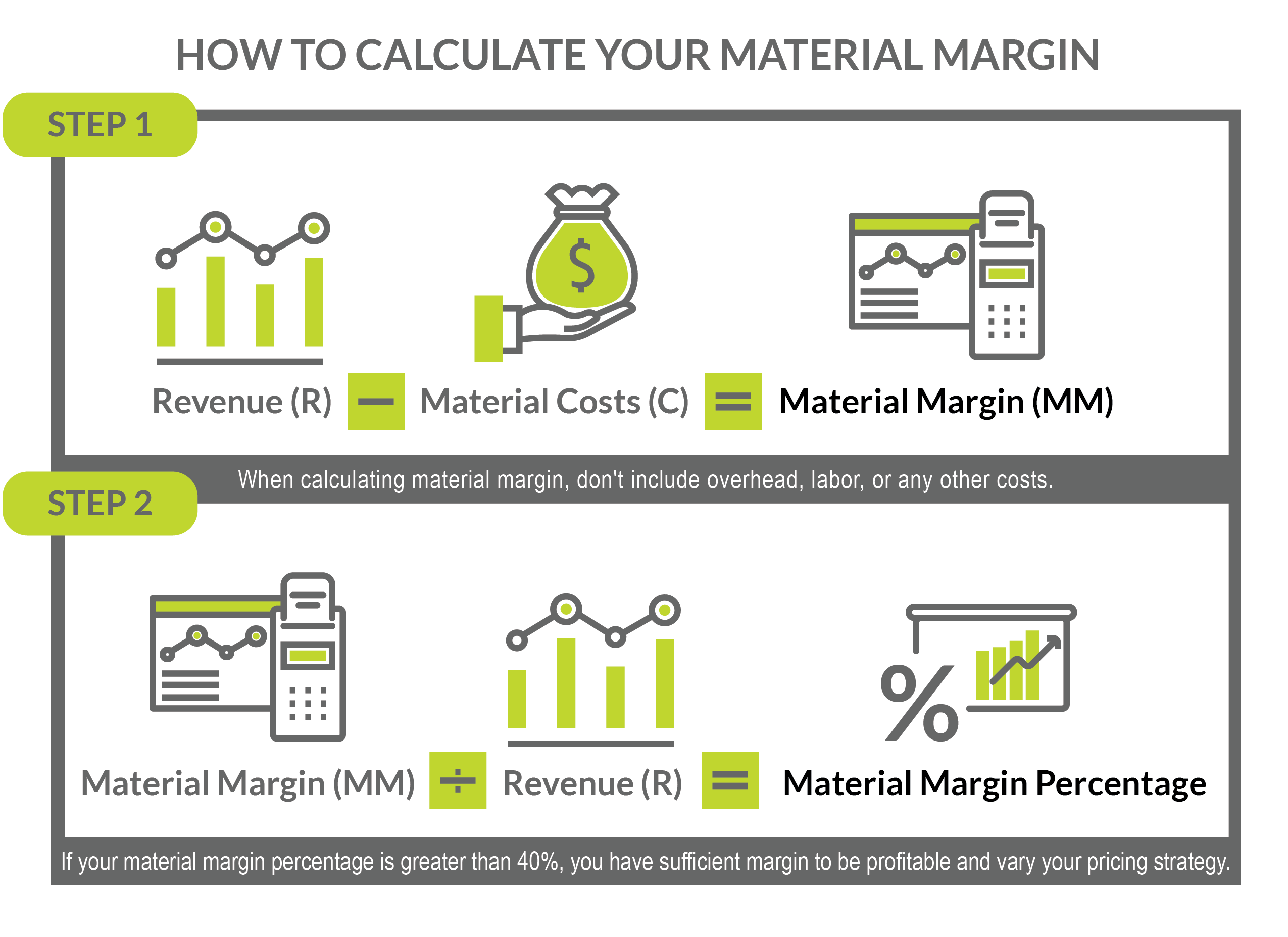

How To Calculate Material Margin And Drive Competitive Pricing

R.

. This can be done for the current financial year and the 2 previous. Average calculated RD claim is 56000. Ad Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credit Incentives.

Steps to calculate the RD tax credit via the traditional method 2. RD Tax Credit Calculator. RD Tax Credits Whether youre new to.

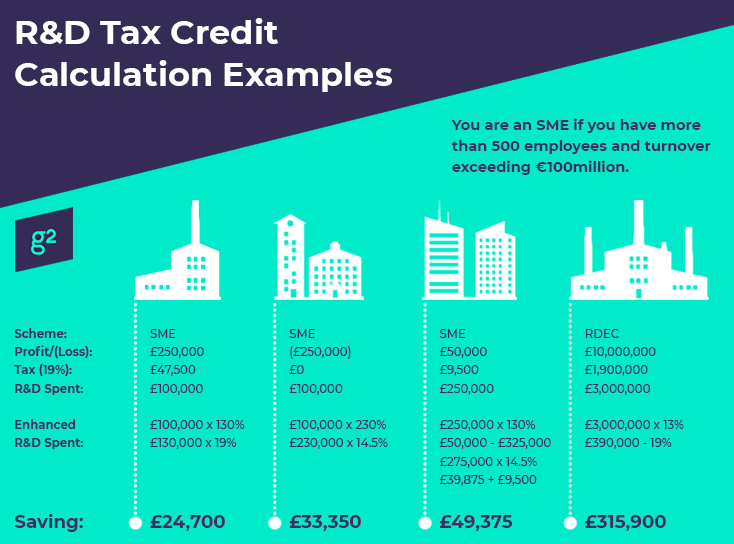

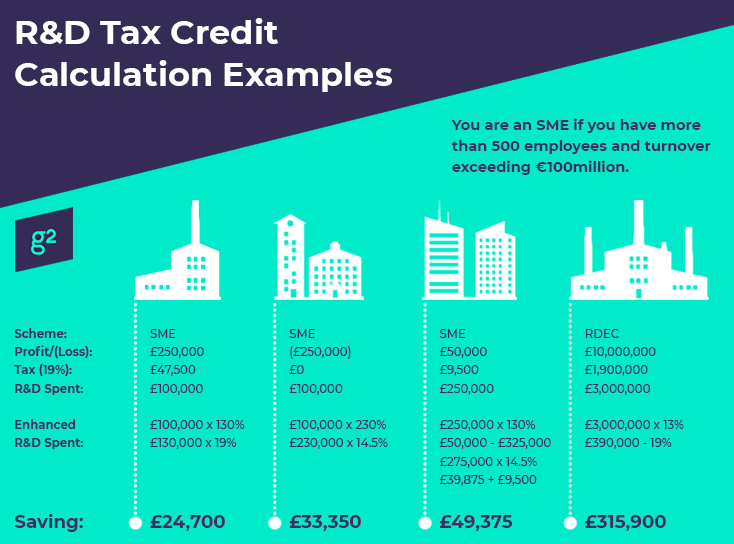

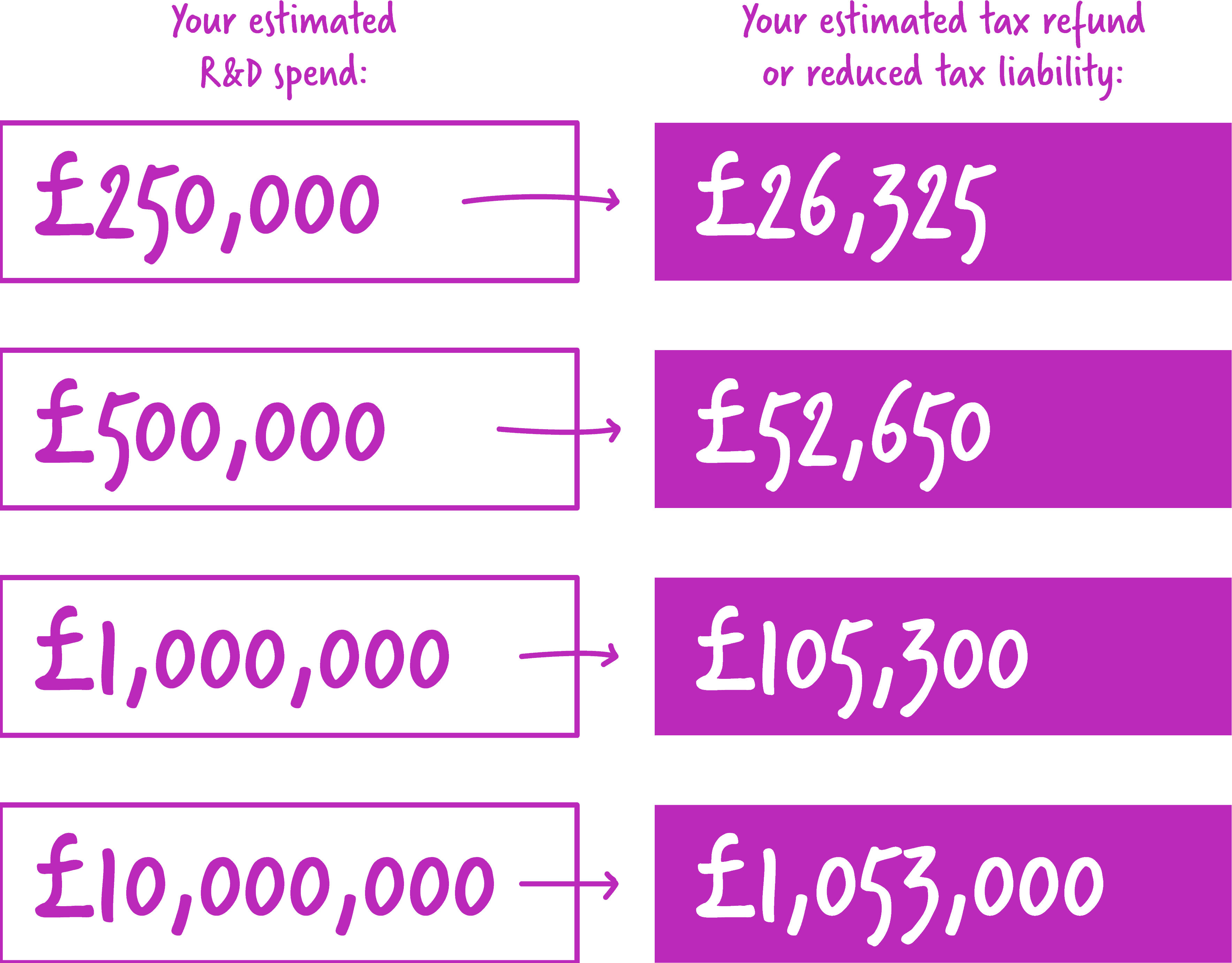

This calculation example shows how RD tax credits can benefit a company via a tax saving of 9500 and payable tax credit of 39875. Across all sectors the average amount reclaimed for our clients is 50000. Our RD tax credit.

Manufacturing Architecture Engineering Software Tech More. Ad Our Highly-Specialised Friendly Team will Maximise your RD Claim. Help me claim R.

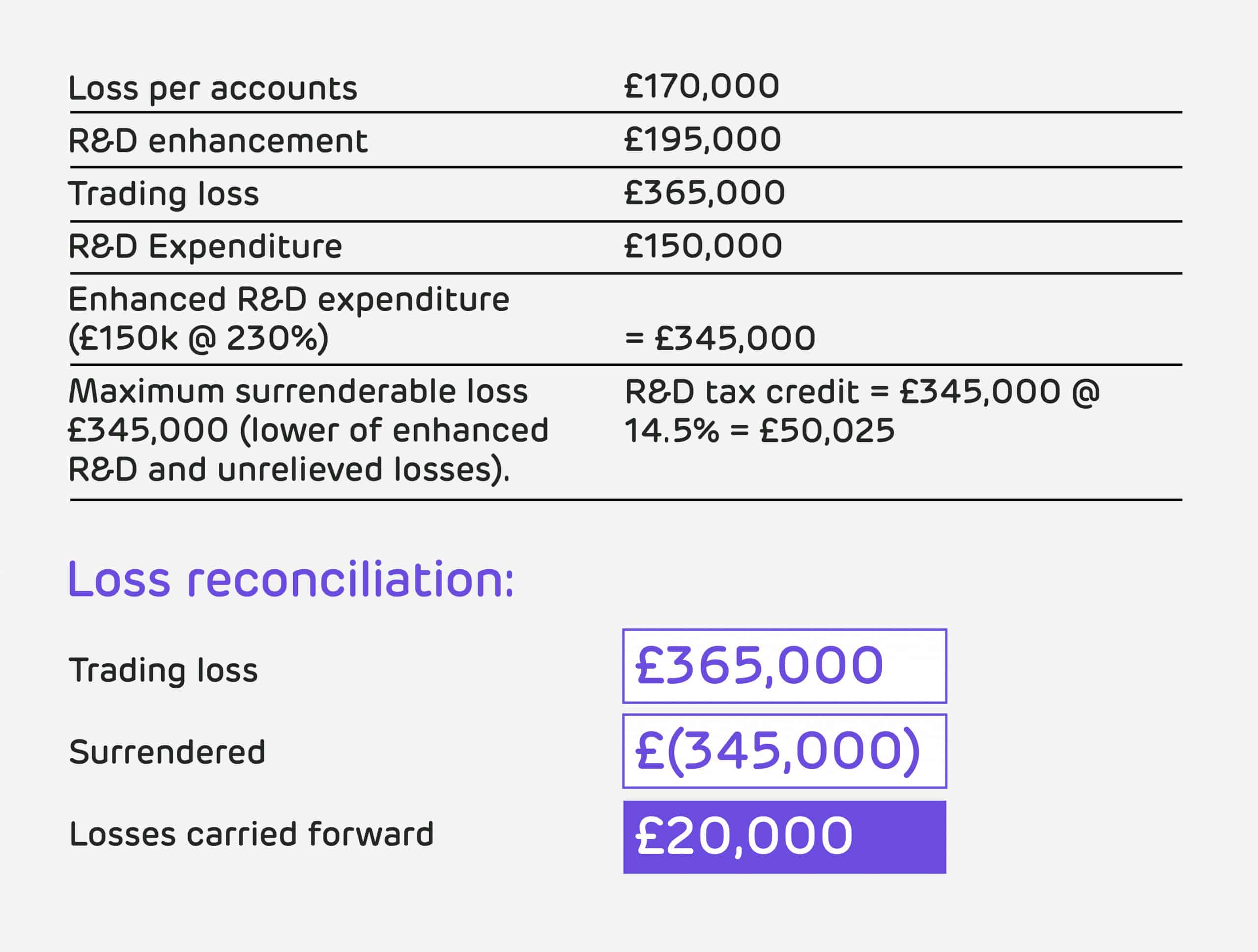

Surrender of losses in return for payable tax credit up to 33 of qualifying expenditure For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss. Calculating RD Tax Credits for a Large. Use our free tool to quickly estimate if youre eligible to claim RD tax relief.

Divide the aggregate QREs by the. Corporation Tax prior to RD Tax Credits Claim. Ad Aprio performs hundreds of RD Tax Credit studies each year.

The qualifying expenditure is 100000 thats already in accounts as expenditure. Select either an SME or Large company. RD Claim for our SME Clients is 32409 are you Claiming Back for your Innovations.

An example of this would be. Ad Our Highly-Specialised Friendly Team will Maximise your RD Claim. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC.

R. Im new to Claming. Total the QREs for the current tax year.

Determine aggregate QREs over a base period. Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credits Today. Just follow the simple steps below.

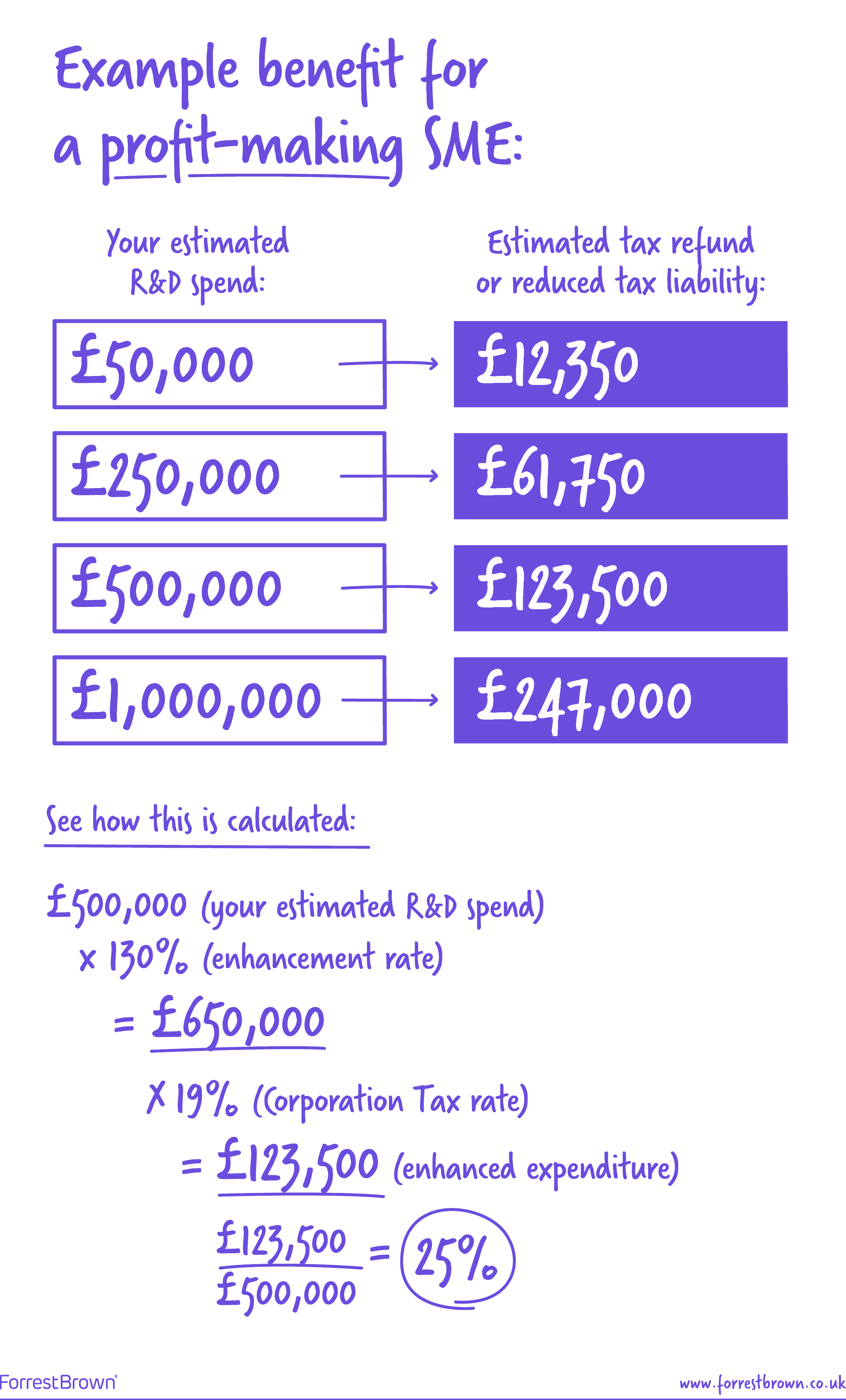

Rd report for Based on the information you provided it looks like we could help you claim back up to for. RD Claim for our SME Clients is 32409 are you Claiming Back for your Innovations. Company X made profits of 400000 for the year calculate the RD tax credit saving.

FInsights FInsights gives you. If the company spent 100000 on RD projects in a year. Guidance on this can be found on our Which RD scheme is right for my company page.

Calculate how much RD tax relief your business could claim back. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. Calculate your companys RD tax credit claim The UK RD tax credit scheme offers UK companies a great opportunity to claim tax relief based on RD costs.

Free RD Tax Calculator.

Capital Expenditure Report Template 1 Professional Templates Budget Template Free Budget Template Excel Budget Template

R D Tax Credits Calculation Examples G2 Innovation

How To Be Proactive With R D Tax Credits Accountants Guide

Sjcomeup Com R D Uk Tax Calculator

Taxable Income What Is Taxable Income Tax Foundation

R D Tax Credits Calculator Free To Use No Sign Up Counting King

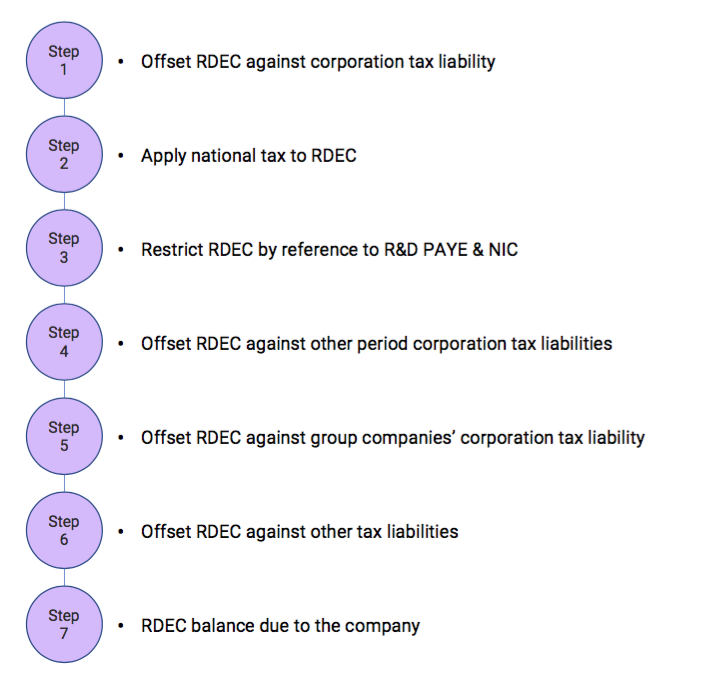

Rdec 7 Steps R D Tax Solutions

Return On Investment Roi Formula And Calculator Excel Template

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Sjcomeup Com R D Uk Tax Calculator

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Rates For Sme Scheme Forrestbrown

How Is R D Tax Relief Calculated Guides Gateley

R D Tax Credits Calculation Examples G2 Innovation

R D Tax Credits The Rsm Way Youtube

Theatre Tax Relief Example Calculation Examples